Corporate profits have been the biggest contributor to inflation in Europe since 2021.

This is according to a study published by the International Monetary Fund (IMF).

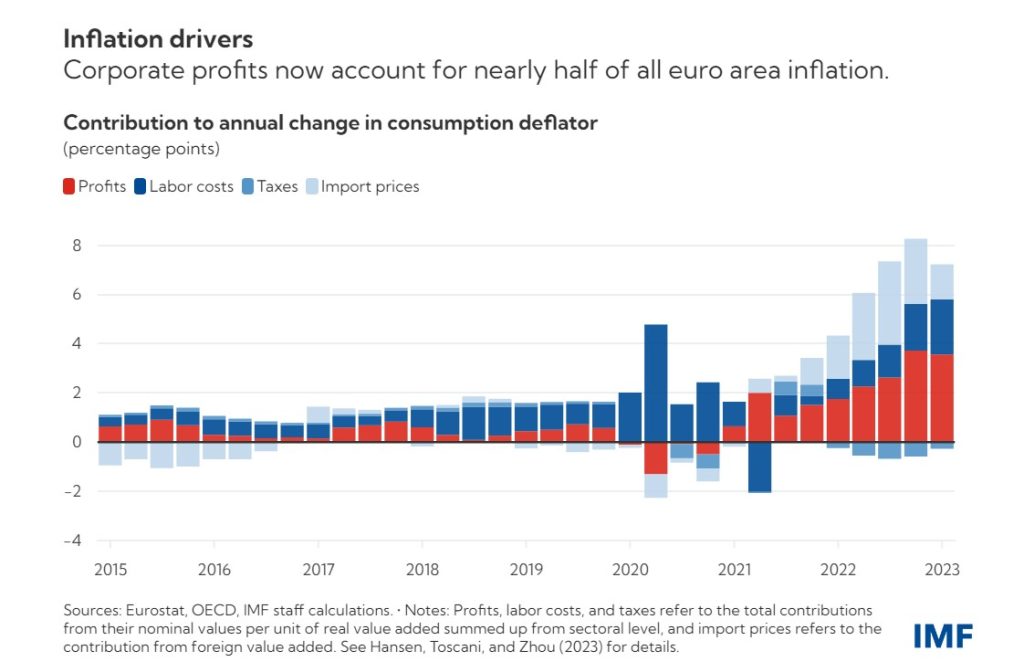

“Rising corporate profits account for almost half the increase in Europe’s inflation over the past two years as companies increased prices by more than spiking costs of imported energy”, wrote IMF economists this June.

The IMF said “companies may have to accept a smaller profit share if inflation is to remain on track to reach the European Central Bank’s 2-percent target in 2025”.

IMF economists Niels-Jakob Hansen, Frederik Toscani, and Jing Zhou detailed their findings in a research paper, “Euro Area Inflation after the Pandemic and Energy Shock: Import Prices, Profits and Wages”.

They found that domestic profits were responsible for 45% of the average change in consumption deflator (inflation) from the first quarter of 2022 to the first quarter of 2023, whereas rising import prices contributed 40%.

The IMF economists added that “the results show that firms have passed on more than the nominal cost shock, and have fared relatively better than workers”.

The share of inflation caused by import prices reached its peak in mid-2022 and has since been falling.

This shows that supply-chain disruptions caused by the Covid-19 pandemic have largely been solved. But corporations have continued hiking prices anyway.

Many neoliberal economists and Western central bank officials have ignored the rise in corporate profits, however, and instead blamed inflation on workers’ wages.

In response to inflation following the Covid-19 pandemic, the European Central Bank and US Federal Reserve have been aggressively raising interest rates, to levels not seen since the 1980s.

Fed chair Jerome Powell admitted that his goal is to “get wages down”.

Former US Treasury Secretary and IMF chief economist Larry Summers called for five years at 6% unemployment or a year at 10% unemployment in order to bring down inflation.

They put the blame entirely on workers, overlooking how companies have exploited a time of uncertainty to make a killing.

Economist Isabella Weber was correct about ‘sellers’ inflation’

Political economist Isabella M. Weber has referred to corporate profits’ significant contribution to rising prices as “sellers’ inflation”.

A professor at the University of Massachusetts Amherst, Weber has spent the past two years warning about this phenomenon – despite harsh backlash from neoliberal economists.

In December 2021, she published an op-ed in The Guardian titled “Could strategic price controls help fight inflation?”

In the debates around inflation, “a critical factor that is driving up prices remains largely overlooked: an explosion in profits”, Weber wrote. “In 2021, US non-financial profit margins have reached levels not seen since the aftermath of the second world war. This is no coincidence”.

She noted that “large corporations with market power have used supply problems as an opportunity to increase prices and scoop windfall profits”.

Weber’s article set off a firestorm, and she was brutally attacked. New York Times pundit Paul Krugman claimed Weber’s call for price controls was “truly stupid”.

In February 2023, Weber published an academic article explaining the phenomenon: “Sellers’ Inflation, Profits and Conflict: Why can Large Firms Hike Prices in an Emergency?”

Contemporary mainstream economists typically discuss three types of inflation: demand-pull inflation, cost-push inflation, and built-in inflation.

Cost-push inflation happens when the prices of inputs used in the production process increase. When the international prices of commodities like oil or gas skyrocket, in response to the war in Ukraine for instance, this contributes to cost-push inflation.

Built-in inflation accounts for expectations that inflation that happened in the past will repeat in the future. Corporations often increase their prices every year, for example, simply because they expect costs to increase, not because they actually did increase (but by doing so, costs do sometimes increase).

However, discussions of inflation among Western neoliberal economists are usually focused on demand-pull inflation.

The godfather of monetarism, infamous right-wing University of Chicago economist Milton Friedman, argued that “inflation is always and everywhere a monetary phenomenon”, and specifically consisted of demand-pull inflation: “too much money chasing too few goods”.

Friedman was an inspiration for Chile’s fascist dictator Augusto Pinochet, who came to power in 1973 in a CIA-backed military coup against the South American nation’s democratically elected socialist president, Salvador Allende.

Friedman was so fixated on government monetary policy that he essentially argued that cost-push inflation doesn’t exist, claiming it was merely a product of demand-pull inflation.

But this recent IMF study shows that the right-wing, monetarist view of inflation is false. Capitalist firms can cause inflation simply by hiking up their profits to unreasonable levels.

ZNetwork is funded solely through the generosity of its readers.

Donate